reit tax benefits ireland

They were first introduced to the UK in 2007. Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets.

Uk Reits A Summary Of The Regime Fund Management Reits Uk

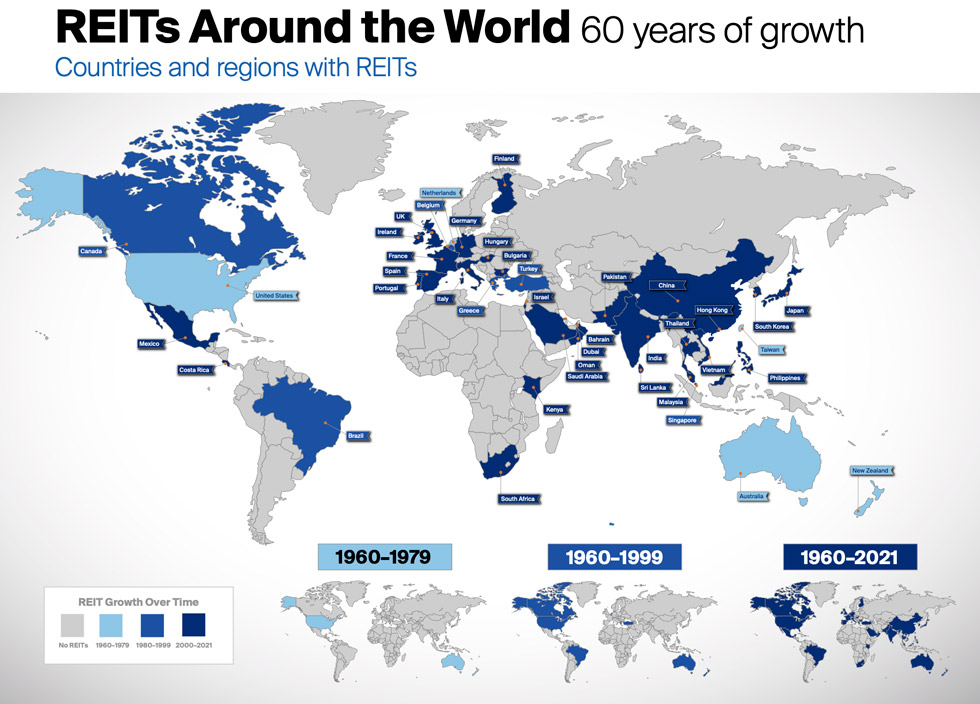

The REIT sector has achieved gains in every month of 2021 thus far including a 177 average total return in May.

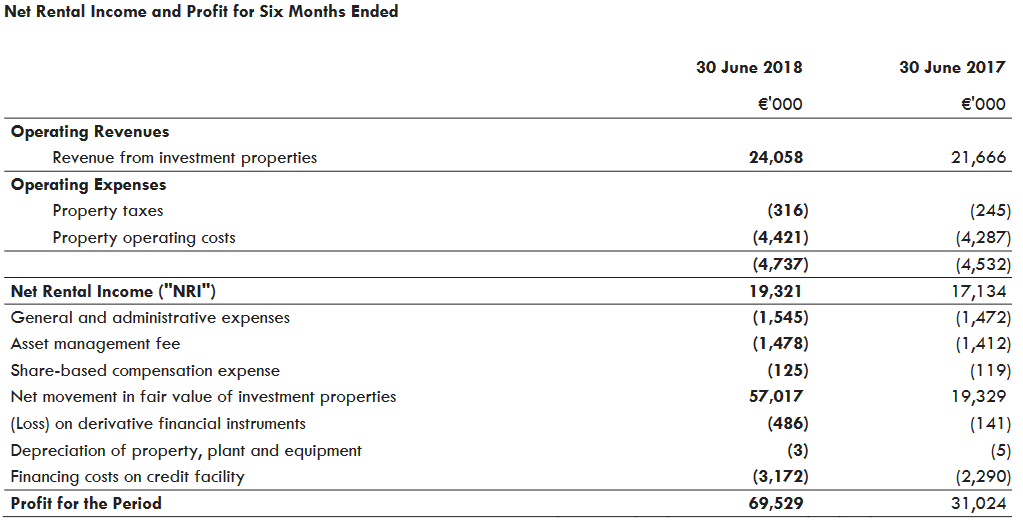

. Limited partnerships and limited liability companies are generally the preferred vehicles for private investment in real estate due to their flexibility low cost and tax efficiency. Web The tax regime for the operation of Real Estate Investment Trusts REIT in Ireland was introduced in Finance Act 2013 which inserted Part 25A into the Taxes. Real Estate Investment Trusts REITS are tax efficient property investment companies.

Real Estate Investment Trusts REITs REITs are companies who earn rental income from commercial or residential property. REITs benefit from a huge tax advantage that goes hand in hand with the 90 payout rule. In addition REIT investors benefit from a 20 rate reduction to individual tax rates on the ordinary income portion of distributions.

Tax benefits of REITs Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025. The transfer of shares in the REIT will be subject to 1 stamp duty. REITs have historically provided investors dividend-based.

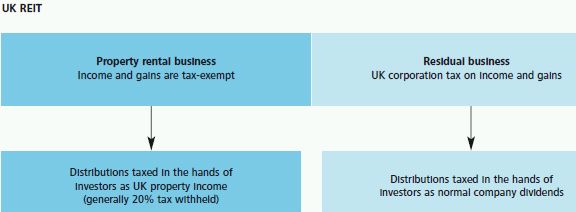

They are generally exempt from Corporation. This allows it to benefit from exemptions from UK corporation tax on profits and gains arising from its property rental business. Conditions for REIT status.

Which Ireland has a double taxation agreement DTA or treaty may be able to reclaim some of the DWT if the relevant tax treaty permits. The tax regime for the operation of Real Estate Investment Trusts REIT in Ireland was introduced in Finance Act 2013 which inserted Part 25A into the Taxes Consolidation Act. The main benefit of having REIT status is profits and.

2 Distributions are not guaranteed and may be funded from. An Irish resident individual owning shares in an Irish REIT will be subject to Income Tax and USC on the dividends from the REIT. It is clear however that there can be significant advantages in choosing the REIT option for some investors.

Want growth income and great tax benefits. It means that REITs invest at least three-quarters of their assets in real estate and must. Heres why REITs deserve a spot in your portfolio.

Here are some of the advantages. Again this could reach a combined rate. Individual REIT shareholders can deduct 20 of.

Property rental business Property. 5824 of REIT securities had a positive total return in May. Qualification as a REIT In order to qualify for the REIT tax regime a REIT must.

1 Be resident in Ireland and not resident. REITs offer investors the benefits of real estate investment along with the ease and advantages of investing in publicly traded stock. Where shares in a REIT are held by an investment.

REITs provide unique tax advantages that can translate into a steady stream of income for investors and higher yields than what they might earn in fixed-income markets. Investors will be subject to 20 withholding tax on distributions from the REIT though Irelands tax treaty network of 68 treaties may enable investors to reclaim some or all.

Real Estate Investment Trusts Tax Adviser

Quick Overview Of Irish Real Estate Rsm Ireland

Tax System Between Reits And Private Landlords Could Not Be Starker Irish Property Owners Association

Real Estate Investment Trusts In Ireland

Loss Of Three Out Of Four Reits Jars With Narrative Of Tax Free Riches Independent Ie

How To Invest In Reits In The Uk Raisin Uk

Diversify Your Income With Irish Reits Seeking Alpha

Nareit Study Shows The Growth And Benefits Of Global Reit Adoption Nareit

Ireland S 2020 Budget Improves Tax Breaks For Companies

Uk Reits A Summary Of The Regime Fund Management Reits Uk

Ireland Inc Bets Big Multinational Footprint Can See Off Tax Overhaul Reuters

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

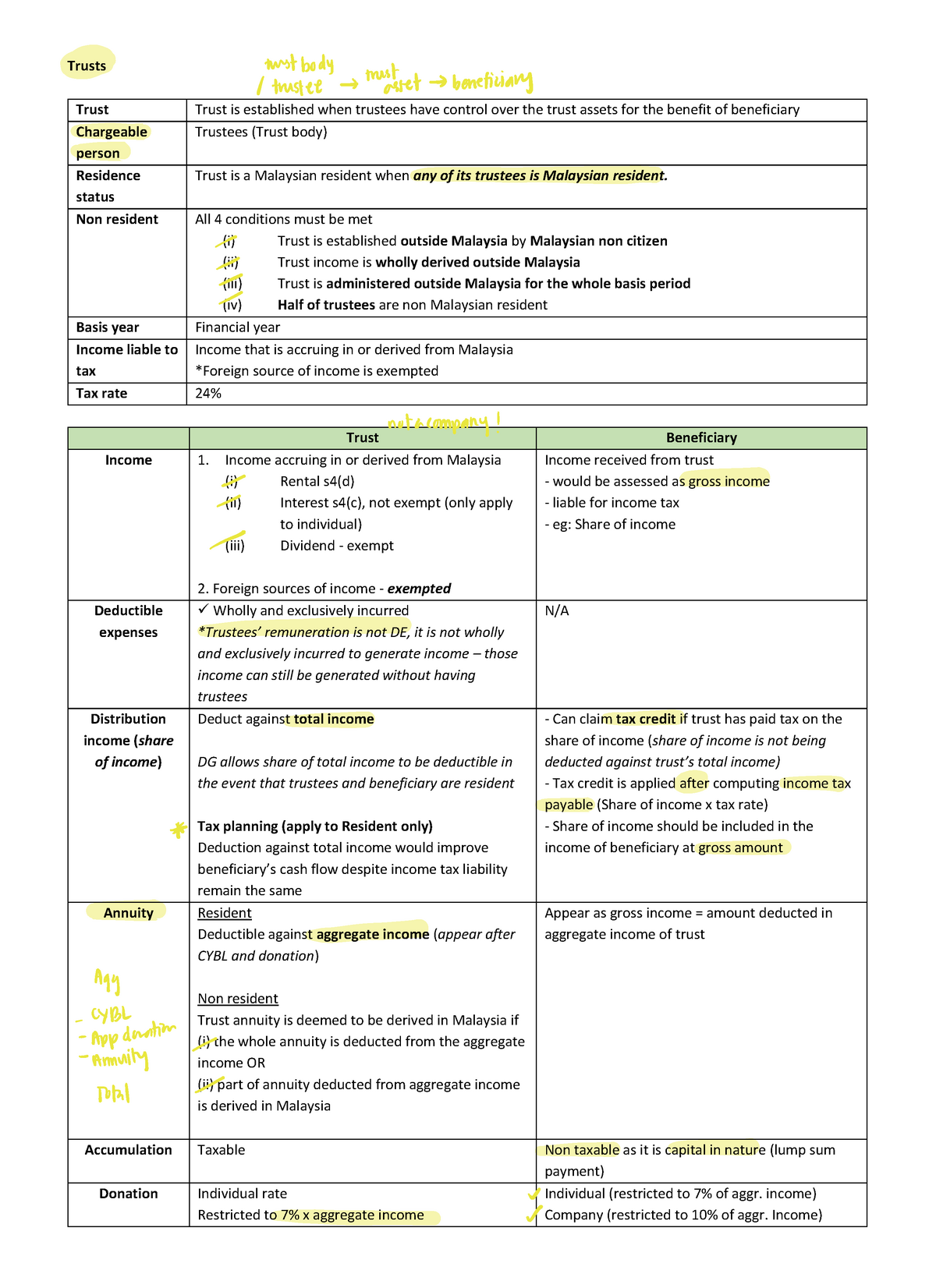

Trusts Unit Trust And Reits Trusts Trust Trust Is Established When Trustees Have Control Over The Studocu

Pdf The Development And Initial Performance Analysis Of Reits In Ireland

/GettyImages-820225090-94d2224ff143430ba34c49e414585530.jpg)

5 Types Of Reits And How To Invest In Them

Housing Minister Says He Has No Responsibility For Sweetheart Deals For Reits

3 Tax Smart Alternatives Cohen Steers

Reit Shares Up On Investor Relief At Government Housing Measures Independent Ie